Contact

RMC

Marnixkade 109F

1015 ZL Amsterdam

Retail Year Review 2022

Summing up the retail year of 2022 in one word proves challenging. The over 10% increase in foot traffic compared to 2021 is entirely attributed to the lockdowns in the first months of 2021. Do we remember? Non-essential stores were closed until April 1, 2021, and from April 1, stores could be visited by appointment. From April 27, stores were allowed to open freely with 1.5-meter restrictions and a maximum number of visitors per store. Essentially, the only part of 2021 that can be compared to 2022 is the first three weeks of January. Thus, comparing 2022 to 2021 gives a distorted view. Starting from May 1, 2022, there was a 5% decrease in foot traffic.

National Trends

The graph below shows that consumer confidence has dropped significantly over the past two years. However, the Retail Index from CBS provides a relatively stable picture, primarily driven by the sharp increase in online sales. For more than 10 years, Bureau RMC has been releasing the National Shopping Index, which tracks foot traffic in physical shopping streets using sensor data. This index reveals that foot traffic in shopping streets has been declining steadily since July 2022, leading to a quiet fourth quarter. Notably, in 2022, after the 1.5-meter restrictions were lifted, Saturday, February 26, became one of the busiest shopping days in the inner cities. The sunny afternoon with temperatures up to 9°C provided many people with their first opportunity to shop freely, and they seized it.

The significant drop in foot traffic from July onwards can likely be attributed to the combination of high inflation, extreme energy prices, and the ongoing war in Ukraine. However, it is striking that consumers only seemed to tighten their spending around this time, with foot traffic decreasing by more than 20% within a few months.

Large shopping areas like home furnishing boulevards and targeted retail centers had a tougher year compared to city centers. Home furnishing boulevards saw a 10% drop in foot traffic, likely partially offset by higher prices per purchase. Overall shopping behavior in streets has shifted towards "Fun shopping becoming Run shopping." As demonstrated last year, foot traffic has decreased in shopping streets, while consumers are more efficient, making fewer visits but spending more per visit. The ability to prepare shopping trips online is contributing to this trend.

The differences between cities in the Netherlands are significant. Smaller cities saw less of a decline due to COVID-19, as many essential stores are located there, unlike in Amsterdam’s Kalverstraat or The Hague’s Spuistraat. Therefore, the recovery in larger cities in 2022, except for Rotterdam, was more substantial than in smaller cities (Amsterdam +22%, Utrecht +23%, The Hague +21%, Rotterdam -12%).

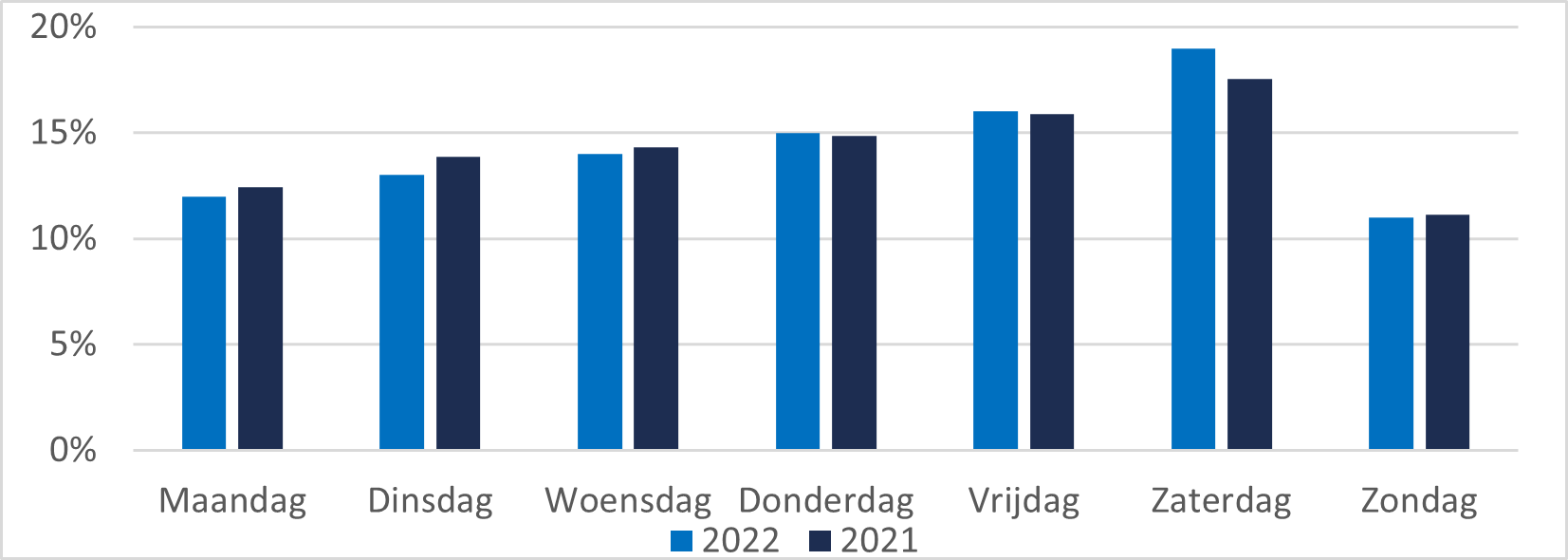

Saturdays Are Busy Again

Last year, Saturdays became relatively busier again, while Sunday traffic did not increase further. This marks the end of a trend that had lasted over seven years, where foot traffic shifted from Saturdays to Sundays, and unexpectedly also to Mondays and Tuesdays. This shift was not observed in 2022, with Saturdays clearly being the most popular shopping day with a 19% share of the week.

King's Day Was the Busiest Day of the Year

As usual, King’s Day was the busiest shopping day of the year in inner cities. This is an event that brings out the largest number of people, but it’s not necessarily good for retailers. Surprisingly, Saturday, February 26, ranked as the second busiest day. This was the first Saturday that people could shop without 1.5-meter restrictions, and the sunny afternoon and pleasant temperatures made it ideal shopping weather. The Friday after Ascension Day was the third busiest shopping day in inner cities, a traditionally busy shopping day. This year, Saturdays before Christmas didn’t make the top 5, and Black Friday was also not among the busiest shopping days.

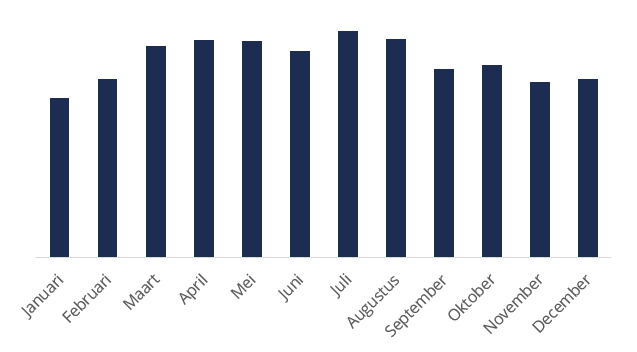

July Was the Busiest Month of the Year

This year, July surprisingly became the busiest month, a time typically marked by sales and holidays. However, the difference between July and December, traditionally the busiest shopping month, was notably larger. The downward trend in shopping street traffic over the last six months likely contributed to this, which was also noticeable during the Black Friday weekend.

15:00 Is the Most Popular Shopping Time

We still prefer to shop in the afternoon, particularly between 14:30 and 15:00. A few years ago, this popular time seemed to shift later in the afternoon, and many cities tried to align shopping hours better with the success of restaurants. However, in 2022, the peak shopping time reverted back to the middle of the afternoon.

Expectation for 2023

Reflecting on the state of shopping streets is something we like to do, but always backed by data on foot traffic. The vacancy rates in 2022 were low, and many stores were converted into housing. But what can we expect for 2023? Hopefully, it will be a year without shopping restrictions, and with the expected decline in energy prices and inflation. The global economic tension from high raw material prices and trade restrictions between China and the US will likely not stimulate the economy. Most economists predict a short recession for 2023. Shopper behavior has also changed in recent years, leading to more efficient shopping trips to the streets. This buying consumer can improve the productivity of the retail floor, and this trend seems likely to continue. Overall, it will be a tough retail year for physical stores, which will have to deal with a negative sentiment. This will likely impact spending behavior and the amount of time people spend in shopping streets. The success of a physical store will depend more on having the right online shopping and research options via other channels. The key to success for retailers will again be their ability to empathize with their target market and serve their customers better than they expect. Quantitatively, we expect a decline in shopping street traffic of 3% to 6% compared to 2022.

Vestigingsplaatsonderzoek om potentie nieuwe locaties Street Jump te bepalen Vestigingsplaatsonderzoek.

Vestigingsplaatsonderzoek om potentie nieuwe locaties Street Jump te bepalen Vestigingsplaatsonderzoek.

Vestigingsplaatsonderzoek om potentie nieuwe locaties Street Jump te bepalen Vestigingsplaatsonderzoek.

Vestigingsplaatsonderzoek om potentie nieuwe locaties Street Jump te bepalen Vestigingsplaatsonderzoek.

Vestigingsplaatsonderzoek om potentie nieuwe locaties Street Jump te bepalen Vestigingsplaatsonderzoek.

What are others saying?

As an alderman, I like to be assisted by knowledgeable people. In the retail field, Bureau RMC does just that, including developing the retail vision. RMC painted a realistic picture. I was also very impressed by the way they led an information evening for all retailers in Alphen.

Alderman for Economic Affairs of the Municipality of Alphen aan den Rijn

RMC has been helping us for years to keep a finger on the pulse of retail in the Netherlands. Their data and reports align perfectly with our needs as a data-driven company.

Head of Market Insights, Vodafone Libertel B.V.

The cooperation with Bureau RMC is pleasant, constructive and solution-oriented.

Strategic Advisor Economic Affairs for the Municipality of Alkmaar

What are others saying?

As an alderman, I like to be assisted by knowledgeable people. In the retail field, Bureau RMC does just that, including developing the retail vision. RMC painted a realistic picture. I was also very impressed by the way they led an information evening for all retailers in Alphen.

Alderman for Economic Affairs of the Municipality of Alphen aan den Rijn

RMC has been helping us for years to keep a finger on the pulse of retail in the Netherlands. Their data and reports align perfectly with our needs as a data-driven company.

Head of Market Insights, Vodafone Libertel B.V.

The cooperation with Bureau RMC is pleasant, constructive and solution-oriented.

Strategic Advisor Economic Affairs for the Municipality of Alkmaar

info@rmc.nl

RMC

Marnixkade 109F

1015 ZL Amsterdam

Powered by © Totoweb and Gonta Creative Agency

RMC is part of MotivactionPowered by © Totoweb and Gonta Creative Agency